The health insurance industry, a colossal and intricate ecosystem, stands at the crossroads of healthcare, economics, technology, and public policy. It is an industry in perpetual motion, constantly adapting to shifting societal needs, technological advancements, economic pressures, and an ever-evolving regulatory landscape. Staying abreast of health insurance industry news is not merely an academic exercise; it is crucial for stakeholders ranging from policymakers and healthcare providers to employers, consumers, and, of course, the insurers themselves. This article delves into the major trends, challenges, and innovations currently shaping the health insurance sector, offering a comprehensive overview of its dynamic present and probable future.

The Regulatory Compass: Navigating Policy Shifts

Perhaps no other sector is as profoundly influenced by legislation and policy as health insurance. In the United States, the Affordable Care Act (ACA) remains a foundational, albeit contentious, piece of legislation that continues to shape market dynamics, coverage mandates, and consumer protections. Recent years have seen ongoing debates about its future, with various administrations attempting modifications, repeals, or enhancements. The news cycle frequently features discussions around ACA marketplace stability, premium subsidies, and the expansion or contraction of Medicaid.

Beyond the ACA, state-level regulations play a significant role, impacting everything from mandated benefits to network adequacy and rate review processes. Globally, nations are grappling with similar challenges: how to ensure universal access, control costs, and maintain quality within their respective health systems, whether through single-payer models, multi-payer systems, or hybrid approaches. News often highlights reforms in countries like Germany, Canada, or the UK, providing case studies for different approaches to health coverage. For insurers, this regulatory flux demands extreme agility, requiring constant vigilance and the ability to pivot strategies to comply with new rules while effectively serving their members.

Technological Tsunami: Innovation as a Core Driver

The digital revolution has swept through every industry, and health insurance is no exception. Technology is not just enhancing existing processes; it is fundamentally transforming how insurance is designed, delivered, and experienced.

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront. Insurers are leveraging AI for:

- Predictive Analytics: Identifying at-risk populations, forecasting healthcare utilization, and optimizing resource allocation.

- Claims Processing: Automating and accelerating claims adjudication, reducing errors, and combating fraud.

- Personalized Member Experiences: Offering tailored recommendations for care, wellness programs, and plan choices based on individual health data and preferences.

- Underwriting: Developing more sophisticated risk assessment models.

Telemedicine and Digital Health Platforms have moved from niche services to mainstream offerings, accelerated by the COVID-19 pandemic. News frequently covers the expansion of telehealth benefits, virtual primary care, and remote monitoring devices. These technologies enhance access to care, particularly in rural areas, and offer convenience that today’s consumers demand. Insurers are investing heavily in these platforms, recognizing their potential to improve health outcomes and manage costs more effectively.

Data Analytics and Interoperability are critical. The ability to collect, analyze, and securely share vast amounts of health data (with appropriate privacy safeguards) is empowering insurers to gain deeper insights into population health, identify care gaps, and design more effective interventions. News about breakthroughs in electronic health record (EHR) interoperability and data-sharing agreements are closely watched, as they promise to create a more connected and efficient healthcare ecosystem.

Wearable Technology and IoT (Internet of Things) are also gaining traction. Smartwatches and other devices can track activity, sleep, heart rate, and more, providing real-time health data. Insurers are exploring how to integrate this data into wellness programs, incentivize healthy behaviors, and offer dynamic pricing models.

Economic Headwinds and Affordability Challenges

The economics of health insurance are perpetually complex, driven by a confluence of factors that make headlines regularly.

Rising Healthcare Costs remain the most significant challenge. Inflationary pressures across the economy, coupled with the increasing cost of medical services, prescription drugs (especially specialty medications), and advanced medical technologies, directly translate into higher premiums, deductibles, and out-of-pocket expenses for consumers. News often reports on drug price controversies, hospital consolidation leading to higher costs, and the overall trajectory of healthcare spending.

Labor Shortages in the healthcare sector, particularly among nurses and specialists, contribute to higher operational costs for providers, which are then passed on to insurers and, ultimately, consumers.

Demographic Shifts, such as an aging population and a rise in chronic diseases, also exert upward pressure on costs. Older populations generally require more medical care, and managing chronic conditions like diabetes, heart disease, and obesity requires sustained and often expensive interventions.

In response, insurers are actively pursuing cost containment strategies. This includes negotiating aggressively with providers, promoting generic drug utilization, implementing value-based care models (which incentivize quality over quantity of services), and investing in preventative health programs. News stories frequently highlight new initiatives aimed at bending the cost curve.

Shifting Paradigms in Care Delivery

The health insurance industry is moving beyond its traditional role of simply paying claims to becoming a more active partner in care delivery and health management.

Value-Based Care (VBC) models are gaining prominence. Unlike the traditional fee-for-service model, which pays providers for each service rendered, VBC ties payments to patient outcomes, quality of care, and overall cost efficiency. Insurers are partnering with Accountable Care Organizations (ACOs) and other provider groups to implement these models, aiming to improve health outcomes while reducing unnecessary spending. News frequently covers pilot programs, successful implementations, and challenges in scaling VBC initiatives.

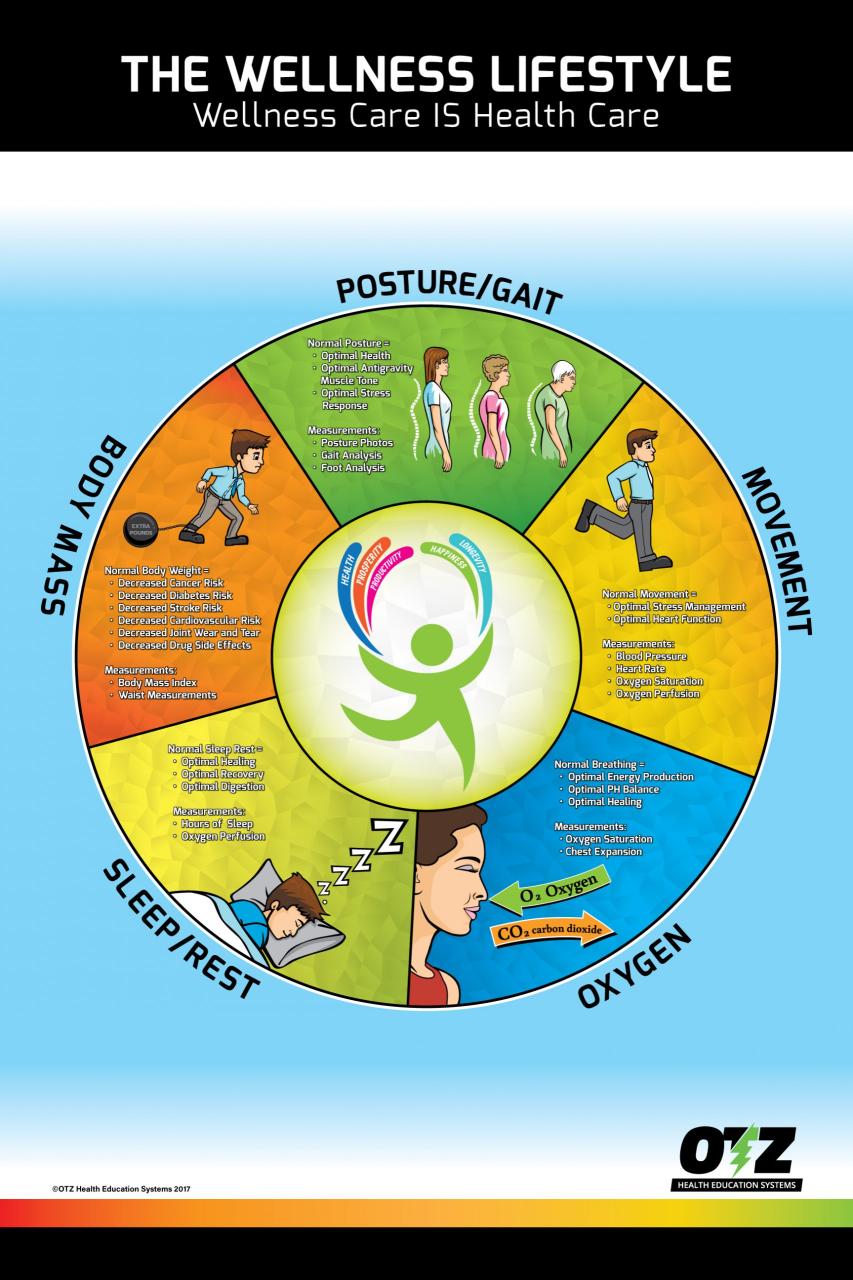

Focus on Preventative Health and Wellness is another key trend. Recognizing that prevention is often more cost-effective than treatment, insurers are investing in programs that encourage healthy lifestyles, early disease detection, and chronic disease management. This includes wellness apps, fitness programs, nutritional counseling, and comprehensive screening campaigns.

Integration of Mental and Behavioral Health Services is also a major focus. There’s a growing understanding of the inextricable link between physical and mental health. News often reports on insurers expanding coverage for mental health services, integrating behavioral health into primary care settings, and leveraging telehealth for mental health support. Parity laws, which mandate equal coverage for mental and physical health conditions, continue to shape these offerings.

Addressing Social Determinants of Health (SDOH) is an emerging area. Insurers are increasingly recognizing that non-medical factors like housing, food security, transportation, and education significantly impact health outcomes. Some innovative programs highlighted in the news involve insurers partnering with community organizations to address these underlying social needs, understanding that a holistic approach can lead to better health and lower long-term costs.

The Evolving Consumer Landscape

Today’s healthcare consumers are more informed, empowered, and demanding than ever before. They expect transparency, convenience, and personalized experiences, mirroring their interactions in other industries.

Demand for Transparency in pricing and coverage is a recurring theme. Consumers want to understand what their care will cost upfront and what their insurance will cover. Insurers are responding by developing more user-friendly portals, cost estimators, and clear explanations of benefits.

Personalization is key. One-size-fits-all insurance plans are becoming less appealing. Consumers are looking for plans tailored to their specific health needs, lifestyle, and budget. This drives product innovation, leading to a wider array of plan options, including high-deductible plans paired with health savings accounts (HSAs), specialized plans for chronic conditions, and wellness-focused benefits.

Digital Experience is paramount. From enrollment and claims submission to finding providers and accessing health resources, consumers expect seamless, intuitive digital platforms accessible via mobile devices. Insurers are investing heavily in user experience (UX) design and mobile app development to meet these expectations.

Consolidation and Competition: A Dynamic Marketplace

The health insurance industry is characterized by significant M&A activity, leading to consolidation among major players. News frequently reports on mergers and acquisitions, driven by the desire for economies of scale, expanded market reach, and diversified service offerings. This consolidation can lead to greater market power for fewer entities, but it also spurs competition in certain segments.

Alongside the established giants, Insurtech startups are emerging, leveraging technology to disrupt traditional models. These agile companies often focus on specific niches, offering innovative digital-first products, personalized customer service, or specialized risk management solutions. Their emergence forces traditional insurers to innovate and adapt, fostering a dynamic competitive environment.

Emerging Risks and Opportunities

Looking ahead, the health insurance industry faces both new risks and exciting opportunities.

Cybersecurity and Data Privacy are paramount concerns. With the increasing digitization of health data, insurers are prime targets for cyberattacks. Protecting sensitive patient information is not only a regulatory mandate (like HIPAA) but also crucial for maintaining consumer trust. News about data breaches or new security protocols are always high-priority.

Climate Change is an emerging risk factor. The health impacts of extreme weather events, air pollution, and vector-borne diseases are becoming more apparent, potentially leading to increased claims and necessitating new risk models for insurers.

However, opportunities abound. The global health market, particularly in developing economies, presents avenues for growth. Further leveraging data analytics can unlock new insights for preventative care and chronic disease management. The ongoing shift towards consumer-centric models allows insurers to build stronger, more personalized relationships with their members, fostering loyalty and improving health outcomes.

The Road Ahead: A Vision for the Future

The health insurance industry is undoubtedly complex, but its current trajectory points towards a future defined by greater integration, personalization, and technological sophistication. The news will continue to chronicle its journey through regulatory shifts, economic fluctuations, and technological breakthroughs. Success in this environment will hinge on an insurer’s ability to:

- Be Agile: Rapidly adapt to policy changes and market demands.

- Embrace Technology: Continuously innovate with AI, digital platforms, and data analytics.

- Prioritize the Consumer: Offer personalized, transparent, and seamless experiences.

- Focus on Value: Shift towards outcomes-based care and preventative health.

- Build Partnerships: Collaborate with providers, tech companies, and community organizations.

The ultimate goal, amidst all the industry news and transformations, remains the same: to provide accessible, affordable, and high-quality healthcare coverage that protects individuals and promotes a healthier society. The health insurance industry, in its perpetual state of evolution, is striving to meet this profound challenge.